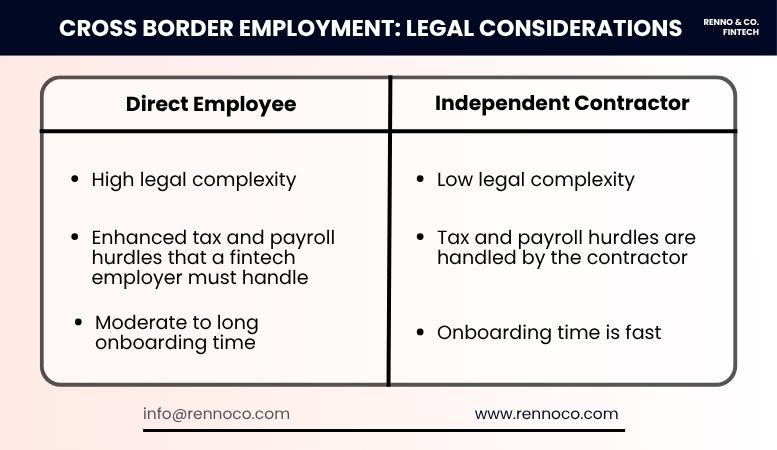

Cross Border Employment: Legal Considerations for Canadian Companies Hiring Internationally

A Canadian fintech can benefit from two key cross border employment options. You can hire a formal employee or a contractor. Learn about both in this guide.

It’s our mission to help fintech and payment companies get licensed in Canada, go live, and stay compliant!

.svg)

Renno will help you launch your fintech in Canada, securing your MSB and RPAA licenses, crafting compliant AML policies, and establishing crucial banking partnerships.

Talk to an Expert TodayRenno will help you launch your fintech in Canada, securing your MSB and RPAA licenses, crafting compliant AML policies, and establishing crucial banking partnerships.

We manage your Canadian MSB registration from start to finish, ensuring you can go live as a payment company and meet all AML requirements.

Your RPAA registration is managed end-to-end, crucial for going live and meeting risk management standards from November 2024.

We secure the right bank or neo-bank account for your fintech, ensuring strong support for your operations.

We develop customized AML policies developed to meet Canadian regulatory standards, keeping your fintech compliant and secure.

Secure your operations with advanced AML services tailored for high-risk sectors including crypto companies.

Access an experienced Canadian compliance team on a part-time basis. Let us handle your AML compliance so you can focus on growing your business.

Our Canadian team conducts thorough AML audits for your MSB, ensuring compliance. Independent audits (or effectiveness review) are required every two years.

Protect Your Innovation

Get expert legal support to navigate the complexities of fintech. We'll draft your contracts and ensure your business meets all regulatory requirements.

Strategize for Success

Strengthen your fintech’s market presence and efficiency with our tailored consulting. We guide you from entry strategies to process improvements.

Ensure your fintech solutions meet Canada's RPAA and the EU's MiCA regulatory standards.

Experience the power of Renno's comprehensive solution, spanning legal counsel and regulatory compliance. You don't need to work with multiple firms; Renno offers comprehensive support, whereas others provide a piecemeal service.

You can rely on Renno's counsel for everything related to Canada's legal and regulatory landscape. Our team is in tune with the latest developments and safeguards your rights and interests in Canada.

We are Fintech lawyers at our core. With extensive expertise in the Canadian Fintech sector, we have the capabilities to facilitate connections for your business that can support its growth.

Partner with Renno today to get started in Canada

Book A CallExplore our latest articles, blog posts, and white papers to stay ahead in the evolving world of fintech compliance.

Read more